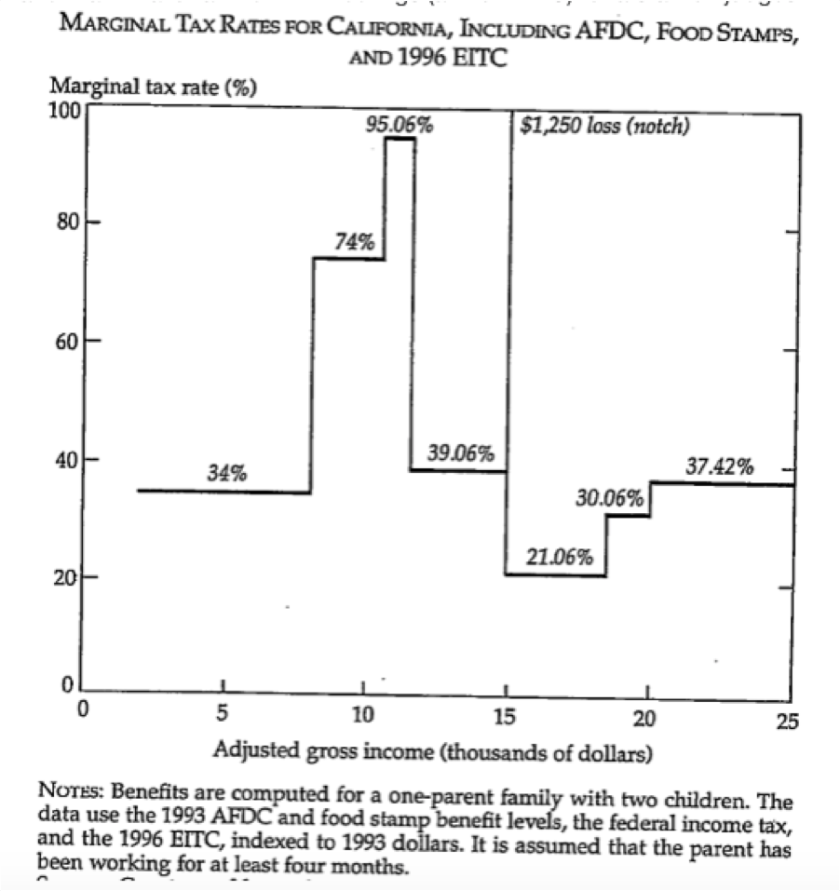

Cliffs, gaps, notches, or discontinuities that occur when an additional dollar of income (or a smidgen of something else) creates a marginal tax rate that is over 100 percent: Some people call this phenomenon the “skyline” tax rate, referring to what marginal income tax rates look like when shown on a graph.

Here are examples:

“[A]s a consequence of a tax code provision penalizing parachutes greater than 3 times taxable income, CEO parachute contracts frequently contain “cutback” provisions limiting the parachute to this threshold. When their companies are acquired, CEOs exercise options in bulk to raise their taxable income and boost their threshold.” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3075467

Illinois’s marijuana ad valorem tax rate for smokeable product with 34.999 percent THC concentration is 10 percent; concentration of 35 percent jerks the rate up to 25 percent. Spraying raw plant material with potent concentrates, or diluting concentrates with CBD or terpenes might let sellers come in just under 35 percent THC. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3481584

And there’s this late 20th century notch, from NTA President Drew Lyon, https://books.google.com/books?id=D_FgitCMcg8C&pg=PA214#v=onepage&q&f=false: