The flat eight percent tax in Virginia’s cannabis legalization proposal is primitive and weak. The cannabis industry must be delighted.

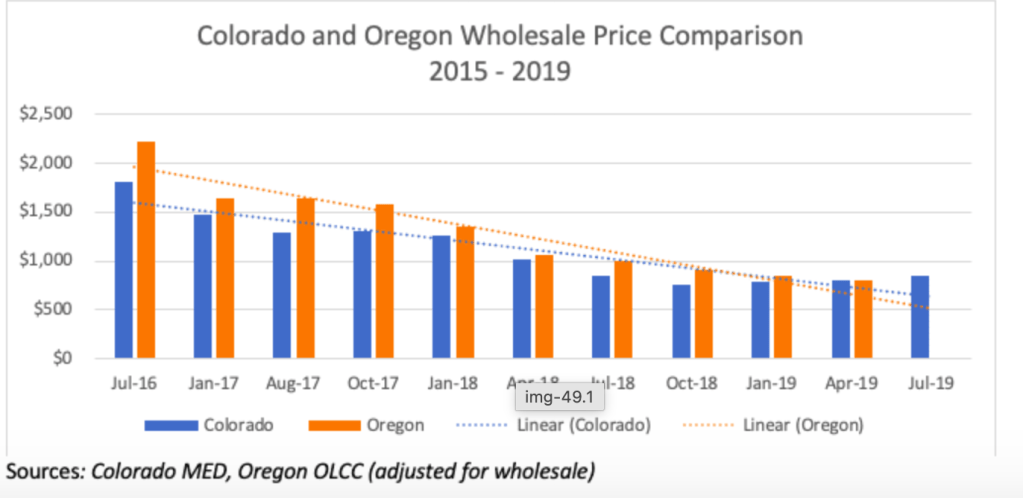

Problem: Under the Virginia proposal, when the price is $200 an ounce, the state gets $16; when the price is $100 an ounce, the state gets $8. But taxes need to go up over time. Think tanks left (ITEP) and right (Tax Foundation) agree. Pre-tax prices will be high at first, then they’ll crash. (In every state, the market matures, and industry gets more efficient.)

Let taxes go up: The after-tax price is what matters in battling the black market.

Weak solution: New Mexico ratchets up its 12 percent price tax to 18 percent by 2030, and the leading Congressional legalization bill ratchet ups from 5 percent to 8 percent.

Strong solution: Tax by grams of THC, the intoxicating molecule. That’s state of the art, and what Canada and Connecticut do. Then when prices collapse, the tax doesn’t collapse, too.

+++

Taxes are the caboose on the train of legalization, and they don’t get much attention.