How does THC correlate with intoxication?

Does a milligram of THC in flower have the same effect as a milligram in an edible?

Yes, supposes the London, England, Mayor’s report. No, say Connecticut and the Marijuana Policy Group.

Continue reading “How does THC correlate with intoxication?”London Mayor’s Report on Cannabis

Here’s the full report, all 320 pages of it, without the necessity of clicking a couple of times and trying to “prove you are human.”

How the NC hemp bill, HB328, bans CBD — This got fixed

After this post, the NC House stripped out the CBD ban and ended up with only age-gating at 21. The bill moves on to the Senate as of June 26, 2025.

Here’s the original post, for the record:

++++++

The primary intoxicant in marijuana or cannabis is THC. CBD, meanwhile. is universally acknowledged to be non-intoxicating .

But the North Carolina Farm Bill Drug bill that passed the Senate and is heading for the House allows THC but bans CBD. That’s crazy!

A Legislator told me I’m missing something — so I may be wrong here. But I offered a reward on Twitter or X for an explanation of what I’m missing, with no takers.

Let’s take a CBD gummy with no THC of any kind. I think it’s a “prohibited hemp-derived consumable product” under North Carolina House Bill 328.

Continue reading “How the NC hemp bill, HB328, bans CBD — This got fixed”State marijuana monopoly and federal illegality

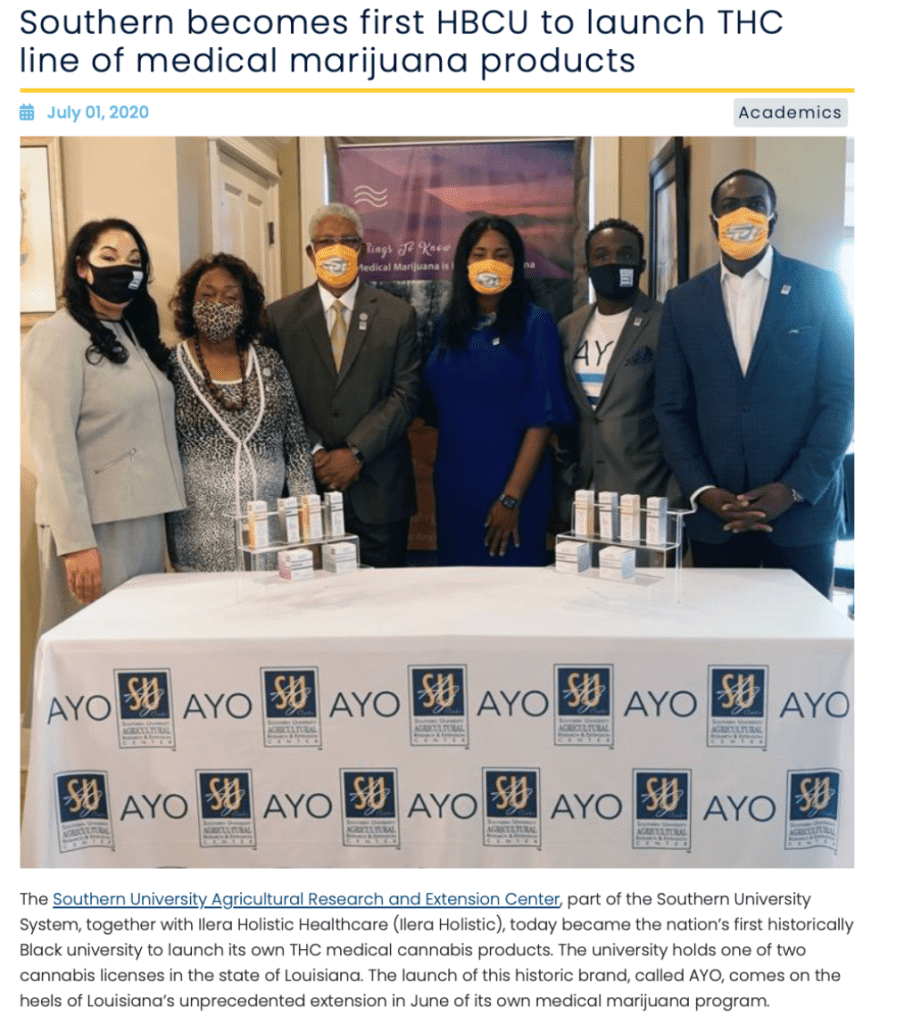

Sure, a state marijuana monopoly would be federally illegal. I used to think it would be bulletproof as a practical matter, in light of Louisiana’s experiment. But President Trump might pick on states that he disfavors, as he does with California localities and ICE. https://www.msn.com/en-us/news/politics/ar-AA1GMkuT

Louisiana’s two land grant state universities had a state monopoly to produce medical marijuana for years before private industry shoved them aside. Here’s a photo from the HBCU, whose inclusion in legislation may have helped with social equity concerns:

https://www.subr.edu/news/southern-launch-thc-line-of-medical-marijuana-products

In a 2013 North Carolina poll, state marijuana sales beat private sales by 3-to-1. The full poll with cross-tabs is at https://newrevenue.org/wp-content/uploads/2013/03/nc-marijuana-polling-march-2013.pdf. Not only do monopolies work best for public health, avoid all kinds of litigation by disappointed license applicants, maximize public revenue, and allow nimble pricing (unburdened by inflexible taxes) to compete with the illicit market; as our Stanford friend Keith Humphreys says, in light of the poor track record of social equity licensing, “In general retail monopolies (that’s where the industry still produces the product; the state sells it) have a better record of hiring diverse employees than do private companies.”

President Trump might leave state marijuana sales in Red-State New Hampshire alone, but he might pick on North Carolina, with our Democratic Governor. It’s about how much risk a state wants to face.

Kind words from a friend

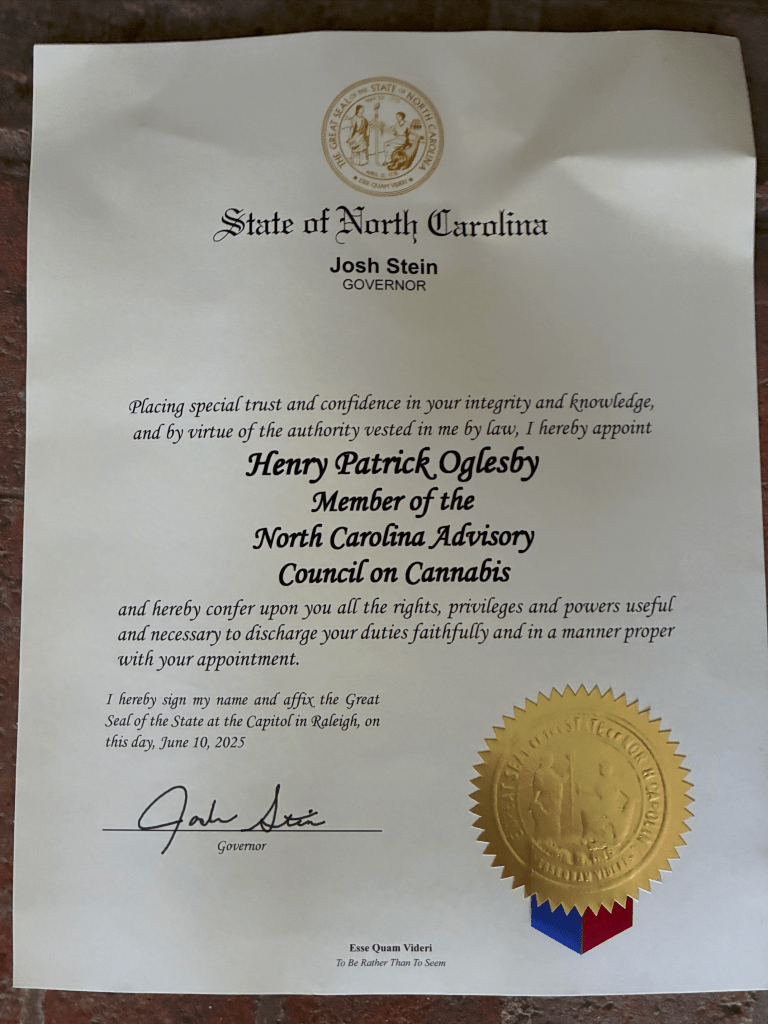

“Pat Oglesby Appointed to Marijuana Legalization Commission

“The governor of NC, Josh Stein, has come out in favor of marijuana legalization and formed a commission, on which my co-teacher, Pat Oglesby, has been tapped to serve, to study the issue and make recommendations.

“This is an outstanding choice! Pat knows more about marijuana legalization, taxation, licensing, and related issues than anyone I know. We co-taught a course, Cannabis Legalization, at UVA Law that was a huge success, due to Pat’s knowledge and connections to industry experts, regulators, and researchers (and to our excellent students, of course).

“The official press release is here, which includes the full list of commission appointees.”

That’s from University of Virgina law Professor Kim Krawiec. https://www.thefacultylounge.org/2025/06/pat-oglesby-appointed-to-marijuana-legalization-commission.html. I hope I can be useful and live up to her expectations.

Appointed to Governor Stein’s Cannabis Council

I’m honored and happy to have this chance.

WEDNESDAY, JUNE 4, 2025

Governor Stein Announces State Advisory Council to Bring Order to Cannabis MarketKids Need Protection

RALEIGH, NC

(RALEIGH) Today Governor Josh Stein released the following statement on the need to protect young people by bringing order to the unregulated cannabis market:

“Today all across North Carolina, there are unregulated intoxicating THC products available for purchase: just walk into any vape shop. There is no legal minimum age to purchase these products! That means that kids are buying them. Without any enforceable labeling requirements, adults are using them recreationally without knowing what is in them or how much THC there is. Our state’s unregulated cannabis market is the wild west and is crying for order. Let’s get this right and create a safe, legal market for adults that protects kids.

“That is why I am announcing a State Advisory Council on Cannabis. I am charging this group with studying and recommending a comprehensive approach to regulate cannabis sales. They will study best practices and learn from other states to develop a system that protects youth, allows adult sales, ensures public safety, promotes public health, supports North Carolina agriculture, expunges past convictions of simple THC possession, and invests the revenues in resources for addiction, mental health, and drugged driving detection.

“I want to thank members of the General Assembly for their interest in addressing this gaping loophole in state law. Let’s work together on a thoughtful, comprehensive solution that allows sales to adults and that is grounded in public safety and health. We can work together and get this right.”

Governor Stein signed the Executive Order creating the Council on Tuesday morning. The Council will include representatives from the Office of State Budget and Management, the State Highway Patrol, the Eastern Band of Cherokee Indians, the General Assembly, and the Departments of Health and Human Services, Public Safety, Revenue, Transportation, and Justice.

Hemp and marijuana are both types of cannabis. The difference used to be how much THC was in the plant. Today, due to the cannabis industry’s unchecked and creative product development and packaging, the terms “hemp” and “marijuana” have lost their traditional meanings and are essentially the same thing. They both contain intoxicating levels of THC. As a result, anyone, no matter their age, can legally buy cannabis products in vape shops with high concentrations of intoxicating THC here in North Carolina. The status quo of zero protection of our kids is absolutely unacceptable. That’s why the work of this Advisory Council to recommend a regulatory structure for cannabis sales is important and urgent.

In the meantime, at a minimum, the General Assembly should prohibit the sales of products that contain intoxicating THC to anyone under 21 by requiring photo ID age-verification and require packaging that lets adults know what is actually in cannabis products, including the amount of THC.

Co-chairs

- Lawrence H. Greenblatt, MD, State Health Director & Chief Medical Officer, North Carolina Department of Health and Human Services

- Matt Scott, District Attorney, Prosecutorial District 20 (Robeson County)

Members

- David W. Alexander, Owner and President, Home Run Markets, LLC

- Arthur E. Apolinario, MD, MPH, FAAFP, 2002-2023 Past President, North Carolina Medical Society; Family Physician, Clinton Medical Clinic

- Joshua C. Batten, Assistant Director for Special Services, Alcohol Law Enforcement Division, North Carolina Department of Public Safety

- Representative John R. Bell, North Carolina House of Representatives, District 10

- Carrie L. Brown, MD, MPH, DFAPA, Chief Psychiatrist, North Carolina Department of Health and Human Services

- Mark M. Ezzell, Director, North Carolina Governor’s Highway Safety Program, North Carolina Department of Transportation

- Anca E. Grozav, Chief Deputy Director, North Carolina Office of State Budget and Management

- Representative Zack A. Hawkins, North Carolina House of Representatives, District 31

- Colonel Freddy L. Johnson, Jr., Commander, North Carolina State Highway Patrol

- Michael Lamb, Police Chief, City of Asheville Police Department

- Peter H. Ledford, Deputy Secretary for Policy, North Carolina Department of Environmental Quality

- Kimberly McDonald, MD, MPH, Chronic Disease and Injury Section Chief, Division of Public Health, North Carolina Department of Health and Human Services

- Patrick Oglesby, Attorney and Founder, Center for New Revenue

- Forrest G. Parker, CEO / General Manager, Qualla Enterprises LLC / Great Smoky Cannabis Company

- Senator Bill P. Rabon, North Carolina Senate, District 8

- Lillie L. Rhodes, Legislative Counsel, Administrative Office of the Courts

- Gary H. Sikes, Owner, Bountiful Harvest Farm and Partner, Legacy Fiber Technologies

- Senator Kandie D. Smith, North Carolina Senate, District 5

- Keith Stone, Sheriff, Nash County

- Joy Strickland, Senior Deputy Attorney General, Criminal Bureau of the North Carolina Department of Justice

- Deonte’ L. Thomas, Chief, Wake County Public Defender Office

- Missy P. Welch, Director of Programming (Permits/Audit/Product Sections), Alcoholic Beverage Control Commission

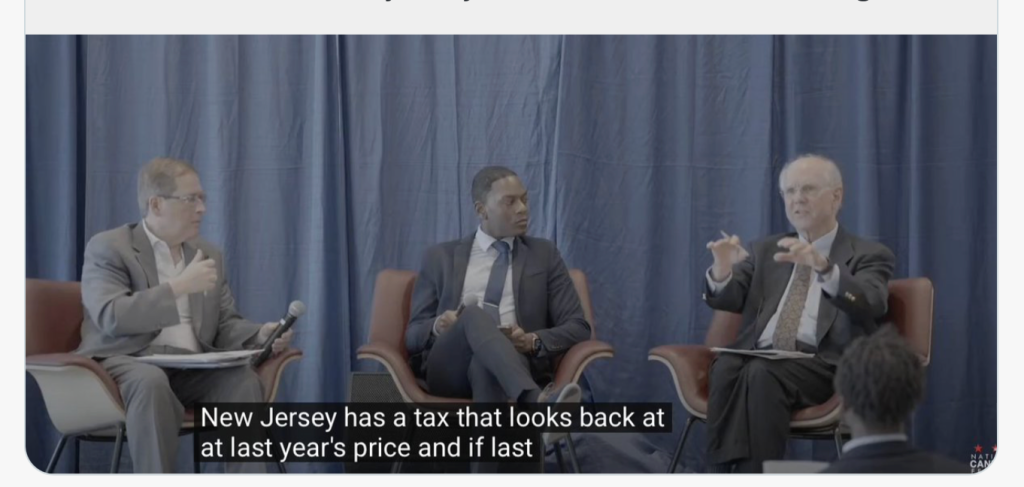

Video with Grover Norquist talking marijuana taxes

From the National Cannabis Policy Summit in D.C. April 28, 2025.

The cannabis tax and markets panel at starts at about the 10’55’’ mark; there’s very weak audio until about 16’40”. Closed captioning may help.

I say, Pre-tax cannabis prices go down over time. What about tax burdens set from the start to go up over time, like NJ and NM?

Grover: “It’s a dirty trick by politicians to have tax increases take place when they’re not in office.” 32′ mark.

Preserving the record: Local votes on marijuana taxes in California in 2016

For history, here are results of local votes on marijuana taxes in California at the time of legalization in 2016– from http://www.drugsense.org/dpfca/votersguide1116.html#LOCALS. Voters liked marijuana taxes better than they liked marijuana legalization. At the end is more detail about counties’ results.

In summary, here’s the percentage of votes for local taxes vs. votes for statewide Proposition 64. These are all the counties where a direct comparison is available.

- Calaveras County 67 for local taxation vs 47 for Prop 64

- Humboldt County 70 vs 67

- Inyo County 65 vs 49.8

- Lake County 62 vs 59

- Mendocino County 64 vs 54

- Monterey County 74 vs 64

- Santa Cruz County 80 vs 69

- Solana County 80 vs 58

Voter Guides / Historical Articles / Contact Info /

Drug Policy Forum of CaliforniaDedicated to news of interest to the California drug reform community

PRESIDENTUS CONGRESSSTATE LEGISLATURELOCAL RACESLOCAL BALLOT MEASURES

. . .

LOCAL BALLOT MEASURES

Also see: Ballotpedia on local tax measures

Adelanto – Measure R would impose an excise tax of up to 5% on all types of commercial marijuana activities. PASSED 67-33%

Avalon – Measure X would permit up to two medical marijuana dispensaries, and permit the delivery, cultivation, manufacture and processing of medical marijuana products, subject to a $10,000 annual license tax and a 12% transaction fee/tax on each individual medical marijuana sale. FAILED 36-64%.

Butte County – Measure L would permit commercial cannabis cultivation, distribution, manufacturing and transporatation in most zones, while prohibiting outdoor cultivation in residential zones and establishing an exemption for personal cultivation of up to 100 square feet, and collective cultivation of up to 500 square feet. Read more. FAILED 42.5-57.5%.

Calaveras County – Measure C would impose a $2/square foot commercial cannabis tax on outdoor/mixed light cultivation until the state establishes a track and trace program, at which point the tax will be $45/pound of dry weight trim and $10 per pound of dry weight trim; and $5/sq ft. on indoor culivation until a track-and-trace program is implemented, at which time the tax will be $70/lb. of bud and $15/lb. of trim; and a 7% on gross proceeds from manufacturing or retail medicinal or legal cannabis. Would require legal water source and compliance with regulations issued by the Water Quality Control Board, Fish and Wildlife, etc. PASSED 67-33%.

Continue reading “Preserving the record: Local votes on marijuana taxes in California in 2016”Hard questions about THC taxes

What if the best way to tax cannabis is by potency, by applying a tax rate to measured quantities of intoxicants, like of THC? Two hard questions loom. Should the same per-milligram tax rate apply to intoxicants in various forms of cannabis products like raw plant material (like flower) and concentrates and edibles? And what tax rates should apply to cannabinoids other than delta-9 THC, like delta-8 and delta-10?

For the second question (Let’s say the best way to tax cannabis is by potency, by applying a tax rate to measured quantities of intoxicants, like of THC? What tax rates should apply to compounds other than delta-9 THC, like delta-8 and delta-10 and HHC, based on relative intoxicating power?) here’s a quick answer (that I in no way vouch for, because no one knows) from perplexity.ai, based apparently on https://therichardrosereport.com/cannasearch-daily-news/:

To design an effective cannabis potency tax framework that accounts for different intoxicating compounds like delta-8, delta-9, delta-10 THC, and HHC, tax rates should reflect their relative psychoactive strength and metabolic impacts. Here’s a science-based approach informed by current research and existing tax models:

Relative Intoxicating Power & Tax Multipliers

| Compound | Potency Relative to Delta-9 | Proposed Tax Multiplier* |

| Delta-9 THC | 1x (Baseline) | 1.0 |

| HHC | 0.7x-0.8x | 0.75 |

| Delta-8 THC | 0.5x-0.6x | 0.55 |

| Delta-10 THC | 0.3x-0.4x | 0.35 |

*Multipliers adjust tax rates based on compound strength compared to delta-9

Why I started studying marijuana tax policy in 2009

In 2009, I was a 62-year old lawyer looking for a pro bono project. My career in law at its high point was designing tax laws for Congress — writing laws to bring in revenue — as a staffer for the Joint Committee on Taxation and then the U.S. Senate Finance Committee.

I started with marijuana taxation back then for several reasons.

1 . I didn’t think people should get arrested for possession. Taxation is the main reason and sometimes the only reason that some voters and representatives want to move beyond prohibition.

2. I’m a tax and spend Democrat. That last reason makes industry people and even activists nervous, but OK.

3. It was fun to think about. The field was wide open. No tax professionals were studying it — industry didn’t really exist to study it, and tax academics turn up their noses at marijuana taxation because they think both excise taxes and subnational taxes are not important. The top people in drug policy were interested, but they had only a nodding acquaintance with tax policy.

4. I figured that possession would get legal, and that commerce was sure to follow, and so was taxation. Marijuana tax policy would get interesting.

By the spring of 2010, I went to Massachusetts at the invitation of NORML board member Dick Evans to speak to a legislative committee about taxing marijuana. In January 2011, State Tax Notes published 25,000 words – “Laws to Tax Marijuana.” https://newrevenue.org/wp-content/uploads/2014/08/laws-to-tax-marijuana-published-version-in-state-tax-notes.pdf.

It has lots of discussion about the tax base but very little about the tax burden, except for this kind of thing: “Tax rates on marijuana need to be low at first to gain advantage in the inevitable price war against bootleggers. As taxing authorities win that war, they can raise rates and generate more revenue.”

Oh, and in 2009, Obama had said, “Yes we can,” and I figured marijuana taxation could be my little part.

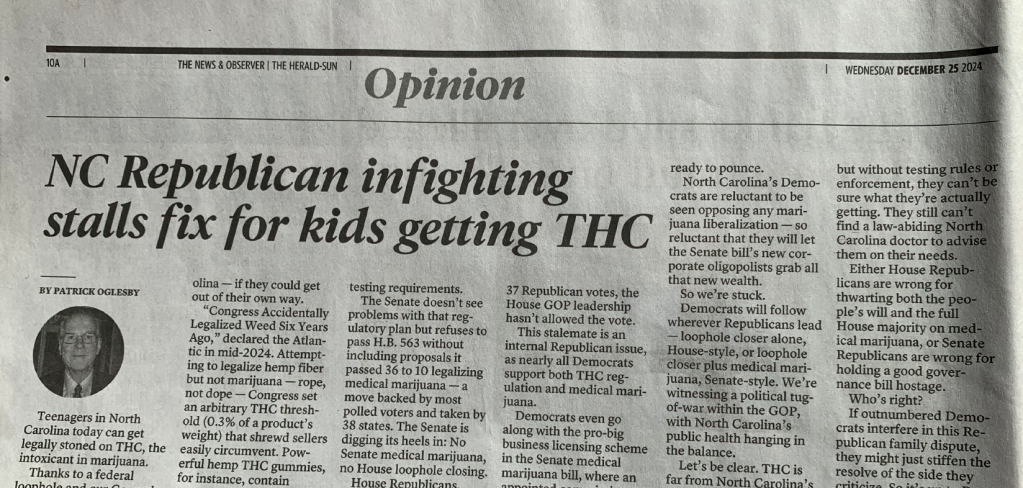

Loophole lets kids buy THC in NC. A Republican stalemate is stalling a fix | Opinion

Here’s the op-ed I wrote, posted December 24, 2024 9:36 AM at https://www.newsobserver.com/opinion/article297404669.html;https://www.charlotteobserver.com/opinion/article297404669.html?tbref=hp;https://www.heraldsun.com/opinion/article297404669.html;

printed in the Raleigh News and Observer, Charlotte Observer, and Durham Herald Sun Christmas day editions.)

+++

Loophole lets kids buy THC in NC. A Republican stalemate is stalling a fix | Opinion

Continue reading “Loophole lets kids buy THC in NC. A Republican stalemate is stalling a fix | Opinion”Joe Murphy

My friend and member of the Board of Advisors of the Center for New Revenue Joe Murphy has gone the way of all flesh. I am grateful for his help. May he rest in peace.

Joseph Richard Murphy Obituary

If you knew Joe Murphy, you have stories to share, most of which are hilarious. His former students reminisce about his truly original sense of humor and irreverence, but also about his brilliance, preparation, and rigorous attention to detail. His colleagues describe an immensely creative, yet “get ‘er done” collaborative work environment, one which was summed up by one of his favorite phrases: “You can’t be afraid to put a wheel in the ditch!” His daughters speak of his generosity and support, but also describe someone who was “always down for a bit of ridiculousness and who relished the theater of the absurd.” When he left us on December 27 at age 77 after a period of declining health, we lost a true original.

Continue reading “Joe Murphy”Marijuana in Texas — Slides

For the nonpartisan Texas Lyceum: 10-minute panel talk, 15 slides: Marijuana, revenue, and hemp

Texas marijuana talk

Errata in Tax Foundation Marijuana tax data — NY, CA, NM

At my age, now that A.I. is taking over proofreading, I feel like a good thing I can do is to set the record straight. For instance, the Tax Foundation’s tax piece of its cannabis posting, https://taxfoundation.org/blog/states-act-2-0-federal-cannabis-reform/, has incorrect information, as of August 12. (I wrote an author August 8 and haven’t heard back.)

It has this:

Continue reading “Errata in Tax Foundation Marijuana tax data — NY, CA, NM”WRAL interview on hemp THC

Hemp THC is wide open in North Carolina. The public and the Legislature hardly notice; the professional prohibitionists know about it but aren’t raising a finger.

The clip is under three minutes. I come in shortly after the one minute mark.

https://www.wral.com/video/nc-lawmakers-consider-next-steps-to-legalize-medical-marijuana/21498062/