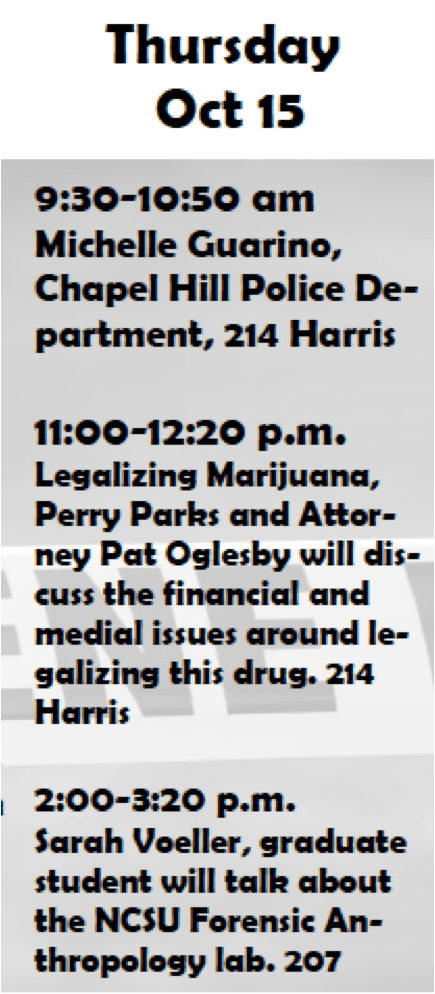

Here: Barnes Sales and VAT 26 October

are slides from my guest appearance discussing Marijuana and Other Excise Taxes at my old friend Peter Barnes’s Value Added and Sales Tax at Duke Law School today, https://law.duke.edu/curriculum/courseinfo/course/?id=320. It’s a joint course with Duke’s Public Policy School course: http://dcid.sanford.duke.edu/courses/rotary-cornerstone-workshop-1. Great fun. Nothing against my fellow U.S. Americans, but it was especially interesting to talk with foreign tax officials learning tax policy at Duke. (They are not onto cannabis yet, and are working on the never-ending issues of tobacco and alcohol.)

No home growing w/o license

From a tax perspective, Ohio’s November marijuana Initiative may be the worst plan ever to reach the ballot. It caps tax rates forever, by Constitutional amendment. (Another objection is that it channels all the new wealth directly to its millionaire funders.)

But the Ohio proposal contains a restriction on home growing that I don’t remember seeing in such a prominent proposal. Home growing is a threat to the millionaires who would seize all commercial growing rights for themselves. So the proposal makes home growers get licenses. But the silver lining for tax enforcement is that licenses will make it harder for home growers to break the rules and start selling in commerce, in competition with the legal, taxed market. If you want a tight tax system, licensing home growers would be part of the plan. Continue reading “No home growing w/o license”

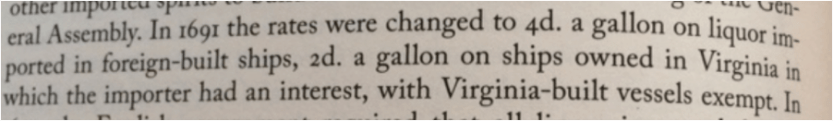

1691 liquor tax break

Tax breaks for special interests are nothing new.

Taxation in Colonial America, by Alvin Rabushka, mentions the Virginia liquor duty of 1691, which provided full duty for most liquor, a 50-percent reduction for liquor brought in on “ships owned in Virginia in which the importer had an interest,” and complete exemption for liquor brought in on ships made in Virgina. Continue reading “1691 liquor tax break”

Taxation in Colonial America, by Alvin Rabushka, mentions the Virginia liquor duty of 1691, which provided full duty for most liquor, a 50-percent reduction for liquor brought in on “ships owned in Virginia in which the importer had an interest,” and complete exemption for liquor brought in on ships made in Virgina. Continue reading “1691 liquor tax break”

Ohio and Esau

Thanks to Ohio State Law Professor Doug Berman, who said this was a “lovely and astute new Huffington Post commentary.”

Marijuana, Ohio, and Esau By Pat Oglesby

“Politics is always the lesser of two evils,” Federal Fifth Circuit Judge John Minor Wisdom told me when I was one of his law clerks. I didn’t quite understand that then, in the late 1970s, but I get it now.

Marijuana legalization is gaining steam, and the question is becoming not “whether to legalize” but “how.” And it’s about the money. A recent RAND report put it this way: “A state that legalizes marijuana by allowing limited private sales creates a privilege to sell it. That privilege is worth money, maybe lots of money.”

So the money is up for grabs. And a small group plans to grab all the money in Ohio. The “Responsible Ohio” ballot initiative, to be voted on in November, lets medical and adult-use marijuana be grown and processed only in “ten designated sites,” all owned by wealthy funders of the initiative. Continue reading “Ohio and Esau”

$150 million Donations to Cut Multinationals’ Taxes

Billionaire Carl Icahn is “currently preparing to form a Super PAC with an initial commitment of $150 million from [him] personally.” His plan is here. While allegedly providing a loophole-closer, stopping inversions, he quickly gets to his anti-tax plan: Tax foreign income of U.S. multinationals lightly, if at all.

One problem is that the multinationals have no problem sticking the “foreign” label on income that should be taxed here right away in full.

$150 million: with 435 House Members, and 100 Senators, that’s $280,000 each. That’s a lot of money for candidates to ignore, and a lot to spend for a tax cut, but Money Talks. Yikes.

Picking Winners to Grow Marijuana

If marijuana is legal, should everyone be able to grow and sell all they want? Free market absolutists would say yes, but there are two reasons to be cautious. First, to protect the public: Some people’s criminal records might make you worry they would sell to minors, or sell untaxed product. Second, to protect the industry: You might want to limit how much can be grown for sale; and if so, you might start by limiting who can grow commercially.

Unlimited commercial growing could flood the market and drive prices way down. Ultra-cheap marijuana could alarm the federal government, leading to a crackdown. It might increase the number of dependent users as well as use by minors, risking a political backlash among parents. Although a price collapse might make consumers smile, it could wipe out small producers and leave the industry in the hands of a few big firms.

So if you want to limit growers, how might you do that? Continue reading “Picking Winners to Grow Marijuana”

Taxation of Medical Cannabis after Legalization

Once marijuana is legal generally, medical users no longer need to prove anything to obtain it. But should they pay tax? This post,[1] written for Vermont in early 2015, looks at a conundrum: Medicine is usually tax-exempt, and marijuana is medicine for some people, but it is a recreational intoxicant for others. Some recreational users fake conditions like chronic pain or insomnia to disguise themselves as patients. That phenomenon threatens a tax on marijuana — if medical marijuana gets a tax break. (A version of this post with footnotes on the same page as text is Part I.A. of this document.)

Continue reading “Taxation of Medical Cannabis after Legalization”

Regulatory Capture — 1933 vs. 2015 — Updated 18 October 2015

A friend says that private industries “may be able to build in regulatory capture from the first day of legalized marijuana” in some states, and asks if the alcohol industry had any “influence on how the newly legal alcohol industry would be regulated after Prohibition was repealed.”

My impression is that regulatory capture didn’t happen so quickly after repeal of alcohol Prohibition. Continue reading “Regulatory Capture — 1933 vs. 2015 — Updated 18 October 2015”

1798 liquor tax — on capacity

“In the 1790s federal excise tax was collected from distilleries based upon the capacity of the still and the number of months it distilled. In 1798, [George] Washington paid a tax of $332 on stills [with a capacity] totaling 616 gallons operating for 12 months.”

That’s from DISCUS, the liquor lobby. It brings to mind a cannabis canopy tax — based on number of crops per year.

Beyond Bud-Trim

Colorado now has seven categories of marijuana to weigh in its de facto weight-based marijuana tax. Wet bud and wet trim are to have different tax rates per gram than dry bud and dry trim. And there are completely new categories of wet and dry “whole plant”

Here’s the language:

(22) “Wet” refers to Retail Marijuana that is not dried or cured. This term includes Whole Plants, Bud and Trim. With respect to any Wet Retail Marijuana, whether or not the marijuana is sold or Transferred before or after being trimmed, the plant material to be sold or Transferred must be weighed within 6 hours of the plant being harvested, and tax must be paid on that weight.

(23) “Whole Plant” means a Retail Marijuana plant that is cut off just above the roots and not trimmed. The weight of the whole plant includes all bud, leaves, stems, and stalk. The Department treats 55% of the weight of a Whole Pant as Bud, 30% of the weight of the Whole Plant as Trim, and 15% of the weight of the Whole Plant as waste. These percentages are calculated into the Average Market Rate. The percentage treated as waste is not subject to the Retail Marijuana Excise Tax. Continue reading “Beyond Bud-Trim”

Humboldt’s Principled Cannabis Tax

A new cannabis canopy tax is on the table in Humboldt County, California. It follows two key principles of tax policy: Tax things you can measure, and collect early.

I. Tax things you can measure

The square footage of area under cannabis cultivation is something you can actually measure. (I’ll use “canopy” here is a shorthand approximation of cultivation area.) Some canopy, you can measure from the air. And some you can even find on Google maps.

Four of the first marijuana taxes in history, the 2010 wave of taxes in Albany, Berkeley, Long Beach, and Rancho Cordova, California, were based square feet of operations. Having the government measure the area being farmed is nothing new. For years, starting in the 1930s, U.S. tobacco farmers were allowed to grow on only a specified land area.

Sure, canopy is a crude way to tax cannabis. Taxing THC might be just right, in theory, as the RAND Vermont report points out. But we can’t measure THC reliably even for concentrates yet. And trying to tax bud (flowers) by THC is futile – like taxing tobacco by tar and nicotine content, which no one does. Yes, canopy doesn’t correlate well with THC, but you can measure it. And a canopy tax, in the long run, will probably be just one of several taxes on cannabis.

OK, indoor grows can’t be easily detected from the air, so the most environmentally unfriendly operations may have the easiest time evading tax. But we can figure out who is using electricity, and there are other ways to detect indoor growing. Continue reading “Humboldt’s Principled Cannabis Tax”

We can’t tax the rich

Republicans are thought of as the party of the rich. Now Thomas Edsall writes in the NYT: “the share of contributions to Democrats from the top 0.01 percent of adults . . . has grown from about 7 percent of total campaign contributions in 1980 to more than 25 percent of contributions in 2012.”

Since even Democrats get so much money from rich people, it’s not surprising that we don’t tax the rich more.

We could start by reinforcing the now-puny estate tax. The arguments that death taxes inhibit enterprise are pretty far-fetched.

Speaking at Meredith College — No

Tribes pay no tax

Forbes tax columnist Robert Wood points out that Indian tribes won’t pay federal income tax from profits on marijuana income. And they won’t incur the 280E penalty.

A Joint Tax Committee document says the Service could change this result itself – as a technical matter, leaving aside politics:

No specific Code provision governs the U.S. income tax liability of Indian tribes. However, the Internal Revenue Service (“IRS”) has long taken the position that Indian tribes and wholly owned tribal corporations chartered under Federal law or the Oklahoma Indian Welfare Act are not taxable entities for U.S. income tax purposes and are immune from U.S. income taxes, regardless of whether the activities that produced the income are commercial or noncommercial in nature or are conducted on or off the tribe’s reservation.

+++++

Wouldn’t a change be the right answer? Wood’s article concludes: “As with many other tax rules, these rules are becoming more controversial. Expect renewed discussion of these rules and their limits in the future.”

Cannabis Canopy Taxes – Smooth or Spiky?

Say you wanted to tax marijuana, and you wanted to big business more than small business. Say the tax base you chose was canopy of grow area. There are two good reasons to tax canopy – first, it’s easy to measure (not manipulable); second, you collect up front (no leakage).

You could make your taxes spiky or smooth.

Here’s how to make them spiky:

The tax rate is $1 a square foot if your farm is 5,000 square feet or smaller, and $2 a square foot if the farm is bigger than 5,000 square feet.

Then, if you have 5,000 square feet under cultivation, your tax is $5,000. If you have 5,001 square feet, your tax is $10,002. That’s a marginal rate of $5,002 per square foot for that one extra square foot. That’s a discontinuity (or a “cliff”), and it looks awkward.

Here’s how to make them smooth: Continue reading “Cannabis Canopy Taxes – Smooth or Spiky?”

Two wrongs for the right

Conservatives of various kinds do not like either marijuana or socialism, but they face the conundrum that if legalization is coming, the social model of government ownership is the safest model. Two wrongs make a right?

John D. Rockefeller, Jr., quoted in the HuffPo piece below, was a conservative economically and socially. And a teetotaler. But he studied alcohol Prohibition hard, and came to understand that state alcohol stores were the safest outlet. Today’s “conservative” opponents of cannabis legalization are unwilling to see the writing on the wall — that legalization is coming. They’re dead-enders, gambling everything on pushing back the tide. They Just Say No. So they’ll get TV ads and flashing neon, and powerful private interests relentlessly pushing legislatures for “Liberalization” — like Big Tobacco and Big Alcohol.

It’s too late for state stores in some states. But not all. And other countries have a free hand. Meanwhile, some folks would legalize all drugs. With for-profit stores selling heroin and methamphetamine?

State pot stores are not for everywhere

HuffPo piece (pasted below) drew this response by “John Thomas”: “you’re going to have a hard (impossible?) time convincing Colorado, Washington, Oregon, Alaska and the several states that are lined up to re-legalize marijuana next year of that.”

Agreed. State operations are most likely in states (1) where people understand the state-store model, like Vermont and maybe someday North Carolina, and (2) where the private industry is not already strong under medical rules. Except for maybe localities like North Bonneville, Washington. My impression is that Alaska’s structure would allow localities to own stores.

Meanwhile, the role of the federal government will not be to get into the cannabis business Continue reading “State pot stores are not for everywhere”