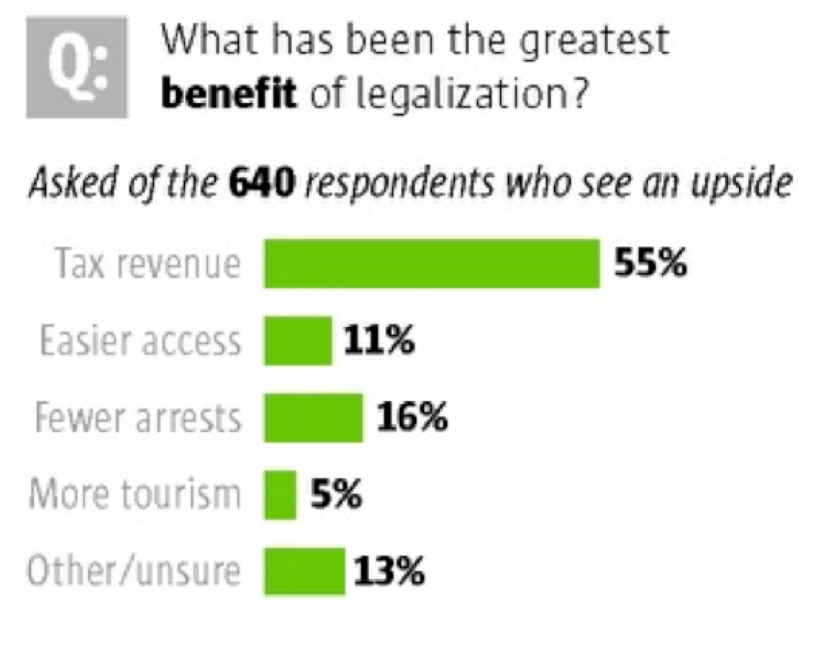

Here are three big issues that I overlooked in “Laws to Tax Marijuana,” printed in State Tax Notes on January 24, 2011. The three biggest I’ve discovered so far, anyway. And a few small mistakes.

1. The high probability that collapsing prices will gut a percentage-of-price tax base. The 2015 RAND Report on Vermont puts it this way Continue reading “Mistakes in 2011 “Laws to Tax Marijuana””