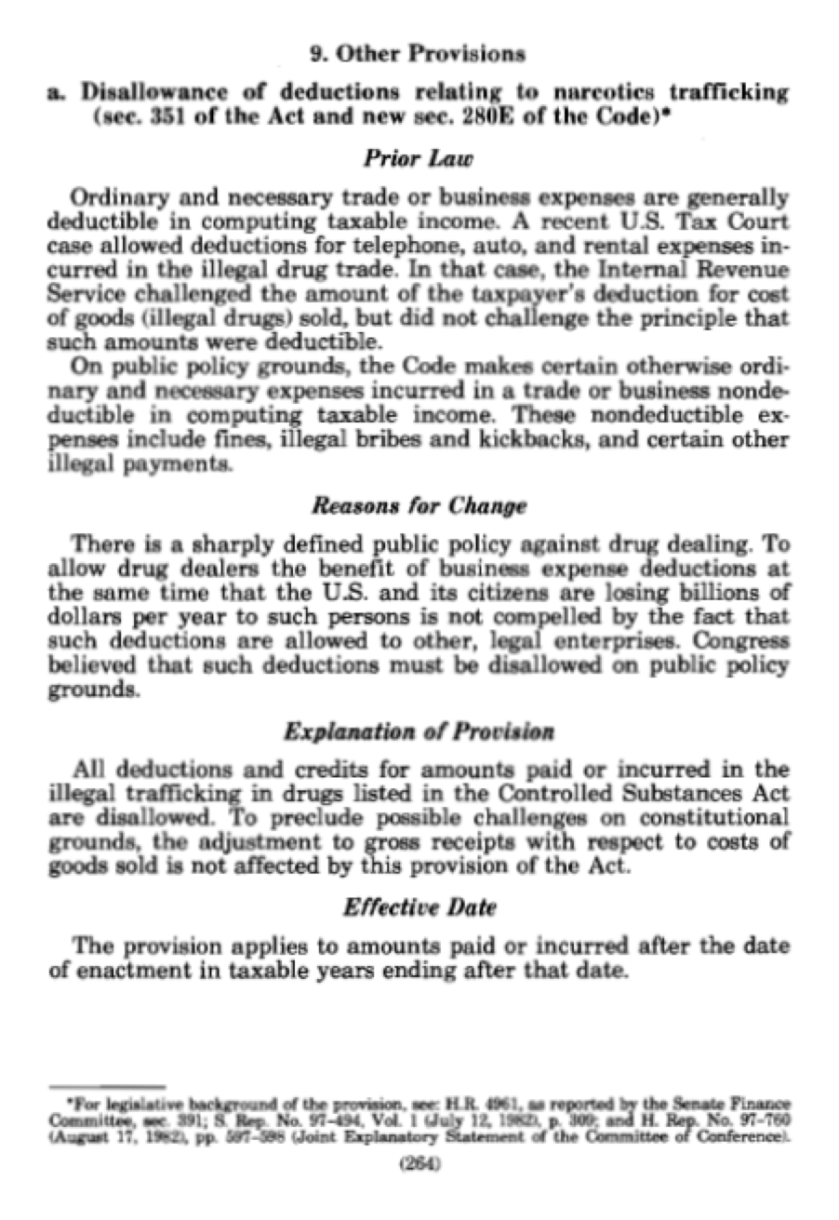

First, here is the text of 26 U.S.C. § 280E, Expenditures in connection with the illegal sale of drugs:

No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted.

(Text is from http://codes.lp.findlaw.com/uscode/26/A/1/B/IX/280E. Added by Pub. L. 97-248, title III, Sec. 351(a), Sept. 3, 1982, 96 Stat. 640. Public Law reference is from http://codes.lp.findlaw.com/uscode/26/A/1/B/IX/280E/notes.)

Second, here is legislative history, from the Senate Finance Committee Report, S. Rep. 97-494, downloadable from the huge file at http://www.finance.senate.gov/library/reports/committee/index.cfm?PageNum_rs=16 (volume 1), page 309 [oops! bad link as of 8 February 2018; try this: https://www.finance.senate.gov/imo/media/doc/srpt97-494.pdf].

That language is picked up with no meaningful change in the Joint Committee on Taxation’s 1982 Blue Book General Explanation of TEFRA: 1982 blue book.

That language is picked up with no meaningful change in the Joint Committee on Taxation’s 1982 Blue Book General Explanation of TEFRA: 1982 blue book.

UPDATE: 280E has its critics, but there are two sides to the story. Parents and others worry about advertising and marketing of cannabis, and 280E discourages marketing expenses, by making them nondeductible. More here (link to http://www.brookings.edu/blogs/fixgov/posts/2015/12/18-marijuana-adverstisement-tax-280e-oglesby.)

I interpret the so-called constitutional challenge as a red herring, intended to prevent overtaxation when vertical integration is not present – the cascading problem. https://newrevenue.org/2013/03/13/the-secrets-of-280e/#more-1735. Taxing gross receipts without a deduction for cost of goods sold wouldn’t be an income tax, which the Constitution explicitly authorizes, but it doesn’t need to be. A national sales tax would be constitutional.

19 thoughts on “Marijuana Tax: Section 280E — Text, Senate Finance, and Joint Committee legislative history”