I’m posting a table covering cannabis sales in Washington that was prepared by Ben Hansen, Keaton Miller, and Caroline Weber – academic economists out west, the first two authors at the University of Oregon, the last at the University of Washington. They authorized me to share it. Click here: table_for_pat_oglesby

The table shows only a small correlation, 0.188, between (reported or claimed) THC concentration and price per gram, so it seems to chip away at the claim that a price tax base is a pretty good proxy for a THC tax.

The research considers about 60 million retail transactions.

If price followed potency directly, if a gram of 10-percent THC cannabis sells for $7, a gram of 15-percent THC cannabis would sell for $10.50 = $7 (15/10).

But in fact, in those 60 million transactions, a shift between 10 and 15 percent potency typically increases the price of a gram by much less than the 50 percent increase in potency.

In Table 1, the regression coefficient of THC concentration for the tax-inclusive price of cannabis in Washington State is 0.188, if I have the terminology right.

Using Table 1: If a gram of 10-percent THC cannabis sells for $7, a gram of 15-percent THC cannabis would sell for $7.94 = $7 + ((15 – 10) 0.188).

Meanwhile, using Table 2: If THC increases by one percentage point, price increases by 2.05 percent. So if a gram of 10-percent THC cannabis sells for $7, a gram of 15-percent THC cannabis would sell for $7.75 = $7 X (1.0205 to the 5th power).

So upon a 50-percent increase in potency, instead of a 50-percent increase in price from $7 to $10.50, the expected price is less than $8. The price increase is less than 14 percent.

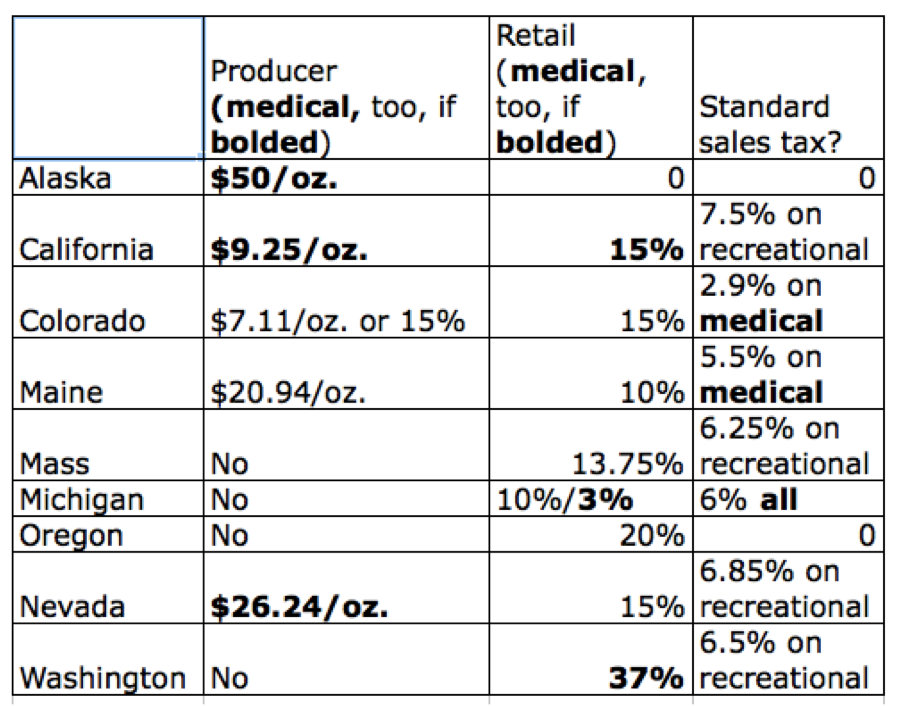

Now the sophisticated weight-based schemes in place in Alaska, California, Colorado, Maine, and Nevada, all tax multiple categories of product. Potent bud is typically taxed at about three times the rate per ounce used for less potent bud. California’s tax for flower is $9.25 per ounce; for leaves or trim, it’s $2.75.

In any event, price is not a very good proxy for potency. Those weight-based taxes may well correlate with potency better than price-based taxes do.